By Jay Landers

Is brine the new oil? It potentially could be, if global demand for lithium — a key component of rechargeable batteries for electric vehicles, energy storage, and consumer electronics — continues to soar. Although lithium is present in various brine formations around the world, to date only certain brine fields in South America have been found to contain lithium in concentrations sufficient to justify the expense of extracting the critical mineral. Elsewhere, lithium is typically mined.

However, the growing demand for lithium, coupled with technological advances in methods used to extract it from brine, is sparking intense interest in what is known as direct lithium extraction. DLE can be done using such sources as oil field, geothermal, and other brines that historically have not proved cost-effective to pursue. The new methods offer the possibility of obtaining vast new sources of lithium from brine cost-effectively and in a manner that is much more environmentally friendly than current approaches.

Against this backdrop, a nascent industry involving a growing number of startup companies, large oil and gas concerns, and automakers is looking to capitalize on the anticipated lithium boom. Meanwhile, security and supply chain considerations are prompting the United States and other nations to try to facilitate the development of domestic lithium sources, in part to reduce their dependence on China, a key player in the lithium market.

Surging demand

In a March 2022 report titled The Role of Critical Minerals in Clean Energy Transitions, the International Energy Agency noted that growing demand for electric vehicles and clean energy technologies is boosting demand for the various types of critical minerals required for their production. Of these minerals, lithium is projected to see the largest spike in demand. By 2040, demand for lithium is expected to increase 42 times relative to 2020 levels, according to the report.

Lithium typically is present in certain hard rock deposits known as pegmatites and in underground brine formations in a dissolved form. As of 2019, more than 80% of lithium was extracted from either Australia, Chile, or China, according to the IEA report. Meanwhile, China accounts for 50%-70% of all lithium refining, the process used to improve the purity of lithium after it has been extracted, the report notes.

Traditional methods for extracting lithium have entailed mining the rock deposits or pumping brine to the surface of salt flats and conveying it through a series of evaporation ponds to concentrate the lithium. Both approaches take a long time to develop, are land-intensive, and can result in significant environmental degradation, says Holly Stower, the resources and environment lead for the Cleantech Group, a research and consulting firm.

Evaporation ponds are particularly destructive, Stower says. The approach “uses huge swaths of land, uses significant amounts of water, and leaves the land heavily polluted,” she says. “It is an environmental disaster.”

Many benefits

By contrast, DLE approaches take the form of filters, membranes, ceramic beads, or similar methods that are designed to precipitate lithium from brine in a manner that in many respects resembles an advanced water treatment facility. But instead of treating drinking water, DLE units treat brine pumped from underlying aquifers.

Depending on a particular brine’s geochemistry, various pretreatment steps are used to remove solids, hydrogen sulfide, and other contaminants. Adsorption, ion exchange, and solvent extraction are among the most common methods under development to extract lithium directly from brine. After undergoing the extraction process, the spent brine is returned below ground via injection wells.

In this way, DLE methods can be set up faster, require a much smaller footprint, and have much less of an environmental impact compared with traditional lithium extraction processes, Stower says. “It uses less land,” she says. “It uses less water. In some cases, it uses less chemical inputs.”

Pairing DLE units with renewable energy sources also could help offset the carbon footprint associated with the process, Stower notes.

DLE “offers lower perceived environmental risk and significant environmental benefits vs. traditional brine ponds,” according to an April 2023 report, titled Direct Lithium Extraction: A potential game changing technology, from the financial institution Goldman Sachs Group Inc. Just as critically, DLE even has the potential to greatly improve operational efficiencies relative to brine ponds, increasing lithium recoveries from the 40%-60% associated with ponds to 70%-90% or more, according to Goldman’s report.

Although it may have high upfront costs, DLE “is cost-competitive when adjusted for higher yields,” Stower says. In other words, brines containing lithium in concentrations once thought uneconomical may now be worth pursuing.

As a result, DLE approaches are expected to increase lithium supplies significantly in the near future, according to a July 2023 Cleantech report.

But Stower stops short of making any guarantees. “I do want to caveat all of this in the context of this is yet to be proven out at a commercial scale,” she says. “Some of these benefits are quite theoretical.”

Alternative sources needed

If lithium supply is to keep up with projected demand, DLE approaches are all but inevitable, says Andy Robinson, Ph.D., the president, chief operating officer, and a director of Standard Lithium, a near-commercial lithium development company whose primary operations are in southern Arkansas.

Until now, the lithium market has focused on developing the “highest-grade lithium resources on the planet,” Robinson says. Much as hydraulic fracturing enabled the production of natural gas from formations previously considered nonviable, DLE can do the same for lithium, he says. “For the lithium industry to keep pace with the demand required by the energy transition story, alternative resources need to be developed.”

For Standard Lithium, the main alternative resource to be developed is the Smackover Formation, a massive brine-laden aquifer extending from eastern Texas to western Florida. The Smackover is “probably one of the best lithium brine deposits outside of Chile and Argentina,” Robinson says. However, due to space constraints and environmental considerations, “it's in a part of the world where you can't build evaporation ponds and use conventional processing techniques.” Therefore, “DLE will play an increasingly large role in unlocking these very large, broadly unconventional lithium brine resources,” he says.

To this end, Standard Lithium is pursuing two DLE projects involving the Smackover in southern Arkansas, including a demonstration plant that is co-located at an existing industrial facility that extracts bromine from brine.

Since beginning operations in May 2020, “we've processed several million gallons of brine through our demonstration plant,” Robinson says. “We are running a small-scale commercial facility, basically, for all intents and purposes.”

Standard Lithium expects to decide next year whether to pursue full-scale development of the facility, according to the company’s website. Standard Lithium also is evaluating development of a second DLE project in southwestern Arkansas.

Working with oil and gas

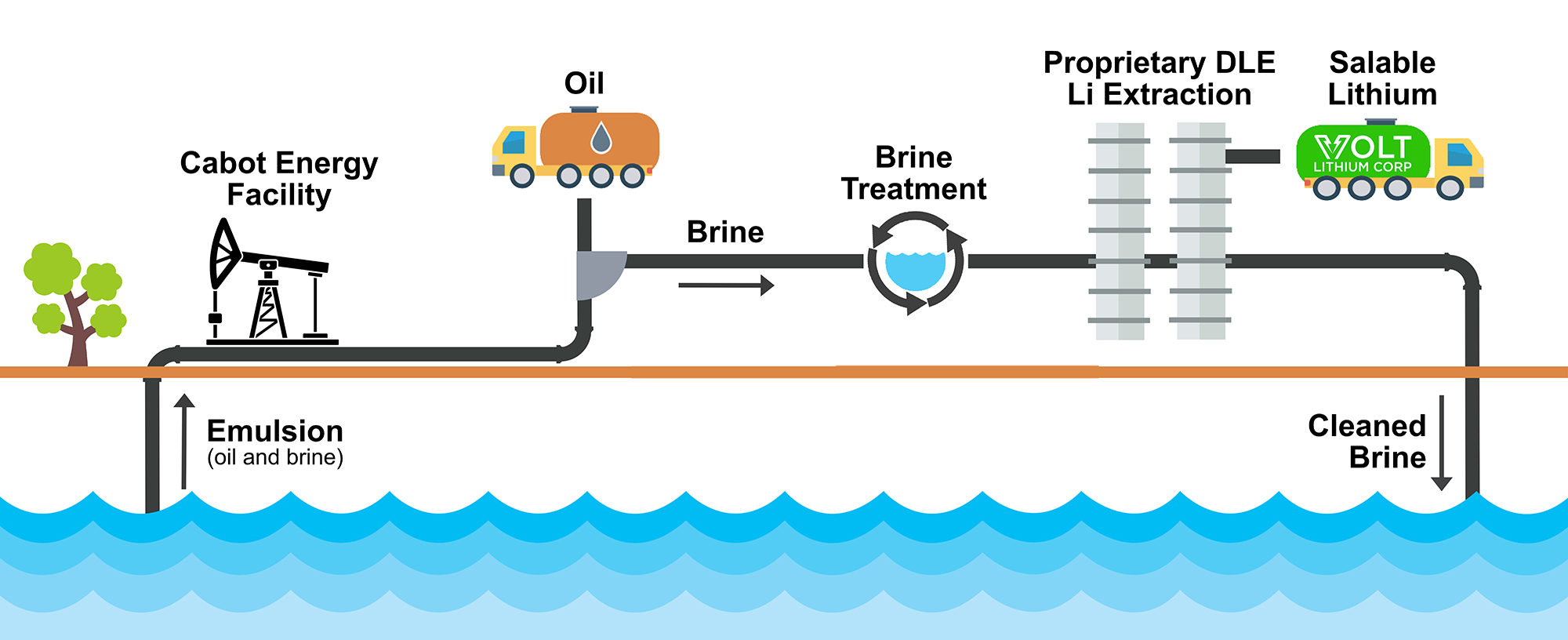

To succeed, DLE companies should collaborate with oil and gas companies that already are producing significant quantities of brine as part of their normal operations, says Alex Wylie, the president, CEO, and director of Volt Lithium Corp., a lithium development company with a proprietary DLE process that is focused on extracting the element from oil field brine.

By partnering with an established oil and gas producer operating in the Canadian province of Alberta, Volt aims to gain access to valuable brine resources without having to finance, design, and construct new wells, pipelines, and related facilities, Wylie says. “The infrastructure is in place today,” he says. “We don't have to spend all the money on the field development, because it's been done by the oil and gas industry.”

Because there is no need to construct extensive subterranean facilities, such an arrangement is also much simpler to obtain permitting for. “The ability to get into production (with oil field brine) is just much more streamlined when you look at other brines across North America,” Wylie says.

Oil and gas producers increasingly are becoming aware of the value of the lithium present in the brine they generate, Wylie notes. “It's a fantastic alternative for them,” he says. “The reserve life for the lithium will outlast the oil, so they can keep their infrastructure running for longer.” If lithium becomes an “additional revenue source or profit center for (an) oil and gas company, I see a huge opportunity for the (DLE) industry as a whole,” he says.

In fact, energy giant Chevron Corp. is looking into lithium extraction, according to a July 24 Bloomberg story. Meanwhile, ExxonMobil reportedly plans to construct facilities in southern Arkansas to extract lithium from the Smackover. (ExxonMobil declined to comment for this story.)

Enter the automakers

Ultimately, the growth of the EV market comes down to increased access to lithium, says Teague Egan, the CEO of Energy Exploration Technologies, also known as EnergyX, a company developing DLE solutions and longer-lasting battery technologies.

“Sufficient availability of lithium and a balance of demand and supply keeping prices lower are key to the success for the electrical vehicle market and decarbonization efforts,” Egan says. “At least in the medium term, there are no battery technologies that are projected to replace lithium. Hence, unlocking the supply of lithium from lower-grade brine sources as well as other unconventional resources is imperative to the success of decarbonization efforts. Lithium production in the U.S. also has implications on simplifying the supply chain for electric vehicles and ensures supply security.”

Recognizing the importance of lithium to their bottom lines, automakers have begun investing in the industry. For example, in April, General Motors Co. announced that it was leading a $50 million funding round in EnergyX.

Besides their financial motivation, automakers expect that investing in the DLE industry will help them meet sustainability goals, Stower says. “From an environmental perspective, those batteries (made of lithium obtained by DLE) will have a better environmental performance and footprint,” she says.

Given the increasing importance of lithium, the United States and a growing number of other governments aim to ensure the availability of the critical material within their borders. “We see a significant amount of funding into lithium innovators from” the U.S. Department of Energy, Stower says.

For the United States and Europe, “there are huge drivers to have control of supply chains,” Stower notes. Chief among them is the fear that the Chinese government might decide to throttle the distribution of lithium from that country to its geopolitical rivals. “There's a huge supply chain risk there,” she says.

This article is published by Civil Engineering Online.